PCCI seeks extension of pandemic-era tax cuts

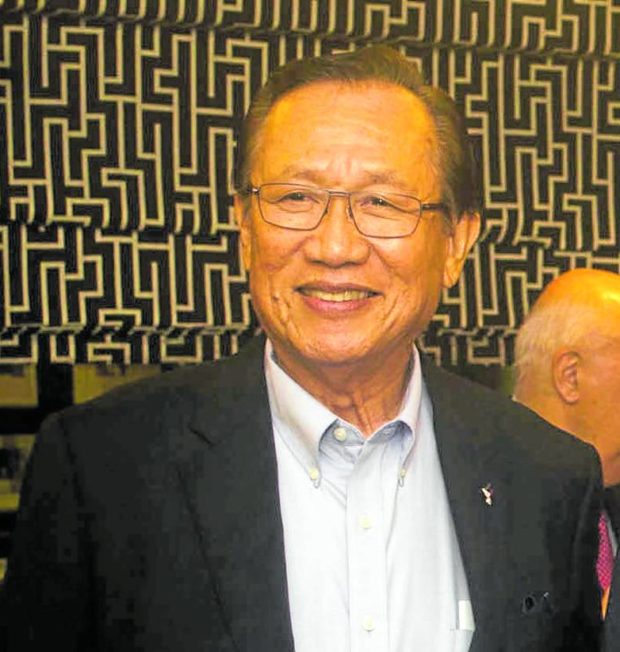

FILE PHOTO: Philippine Chamber of Commerce and Industry President George Barcelon. INQUIRER

The country’s largest business organization is amenable to an extension of the government’s pandemic-era tax cuts until the end of 2023 instead of another two years.

The Philippine Chamber of Commerce and Industry (PCCI) was referring to the percentage tax and minimum income tax, both of which were lowered under the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act.

READ: Duterte signs CREATE bill into law

“Companies have not really been able to take advantage of it. I hope that the government (Bureau of Internal Revenue) will consider extending it, hopefully within the end of the year so that we can start for the new year,” PCCI chair George Barcelon said in a statement.

The CREATE Act had sunset provisions where the percentage tax, which was lowered to 1 percent, will go back to 3 percent, while the minimum corporate income will return to 2 percent from 1 percent by June 30, 2023. —Alden M. Monzon