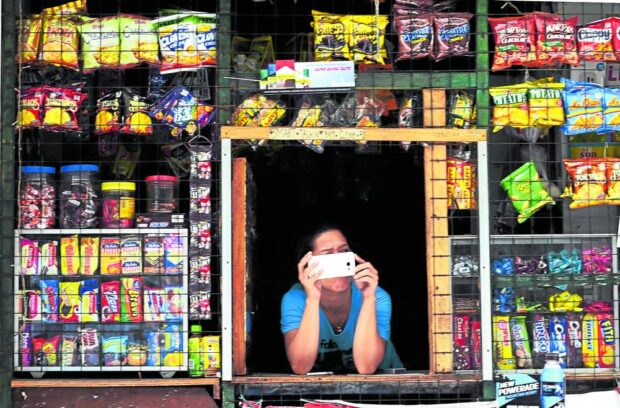

INQUIRER FILE PHOTO

The Joint Foreign Chambers of the Philippines (JFC) on Thursday called on the government to reconsider imposing new taxes on junk food and raising existing ones for sugar-sweetened beverages, marking the first major pushback from business groups concerning the tax policy direction.

JFC, a coalition of the American, Australian-New Zealand, Canadian, European, Japanese and Korean business chambers, as well as the Philippine Association of Multinational Companies Regional Headquarters Inc., said there should be a careful reassessment of these additional taxes as these would be inflationary for local consumers and discriminatory to certain businesses.

‘Not the right time’

“We believe it is not the right time to introduce additional taxes on products primarily consumed by middle and lower middle-class households because the country is still recovering from the pandemic and a prolonged period of high inflation,” JFC said in a statement.

“The proposal would also affect micro and small enterprises that rely on selling these products as a source of income. Imposing additional taxes will only strain the capacity of businesses in affected sectors to continue operations and grow their businesses, especially when issues related to the supply of certain raw materials remain unresolved,” the coalition added.

Health issues, revenues

JFC suggested that the impact on consumption and health of the existing sugar-sweetened beverages taxes imposed under Republic Act No. 10963, otherwise known as the Tax Reform for Acceleration and Inclusion (TRAIN) Act, be fully studied and presented.

“We also strongly recommend the prioritization of improvements to tax administration, such as in the proposed Ease of Paying Taxes Act, and nontax interventions as alternative, noninflationary measures to raise government revenues and improve health outcomes of Filipinos,” the group added.

The Marcos administration is reviving a plan to tax junk food and increase those for sweetened drinks, citing that the goal is to address health issues especially among children, as well as generate additional revenues for the government.

Finance Secretary Benjamin Diokno said this was a “proactive measure to address diabetes, obesity and noncommunicable diseases related to poor diet.”

Under the proposal, a tax of P10 per 100 grams or P10 per 100 milliliters would be imposed on prepackaged food products that lack nutritional value.

Antipoor

Meanwhile, the increased tax for sweetened beverages under the TRAIN Act will be raised to P12 per liter, or double the current level, regardless of the type of sweetener used in these consumer goods.

Various groups criticized the plan, with Bayan Muna executive vice president Carlos Isagani Zarate saying the proposed imposition of excise on sweetened drinks and junk food was antipoor.

He noted that imposing junk food taxes would not solve health problems, but only burden the poor and marginalized who have limited access to healthier food options.

READ: Tax on junk food, higher soft drink levy pushed