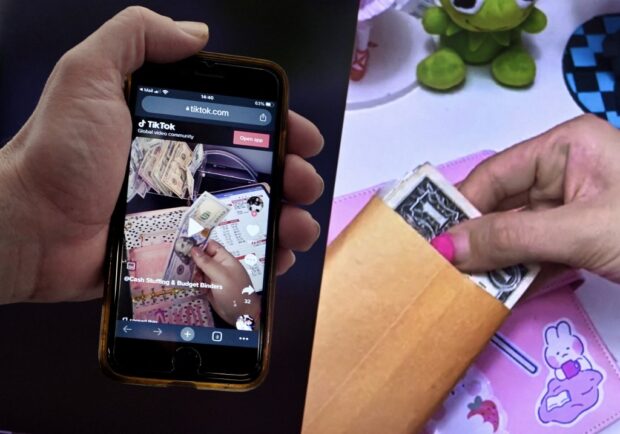

This illustration picture shows the “cash stuffing” TikTok trend, videos where people put cash in envelopes as a budgeting method, displayed on a smartphone in Washington, DC, on March 15, 2023. (Photo by OLIVIER DOULIERY / Agence France-Presse)

WASHINGTON — Manicured fingers meticulously place banknotes in transparent envelopes marked “food,” “gas” and other categories, demonstrating in a TikTok video a retro technique for controlling what you spend.

Returning to cash to control spending may be old-fashioned, but in an era of high inflation, a growing number of money-conscious consumers find that it works.

Judia Griner, 25, started “cash stuffing” two years ago when she was a student at Old Dominion University in Virginia. Now, her TikTok account has more than 200,000 followers.

“I was like, I need to somehow use my own money to pay off the tuition so I won’t be in too much debt,” Griner told Agence France-Presse (AFP).

“I realized that I had no idea how to do that, because I just didn’t know how much money I had,” she said. “I would swipe my card, and I would just kind of cross my fingers and hope that it wouldn’t be declined.”

It was a similar situation for 31-year-old Jasmine Taylor, who launched her TikTok channel in February 2021 and now has more than 620,000 followers.

“I had a degree but no outlook for a job. My finances were bad,” said Taylor, a Texan.

Both women decided the way to turn around their spending behavior was to rely on the technique of paying cash for everything.

Once they cash in their paychecks, they separate it into different envelopes for specific expenses — rent, shopping, etc.

On TikTok, the hashtag #cashstuffing has now reached more than 930 million views.

Piggy bank system

The method is reminiscent of the age-old piggy bank system and was popularized in its current form 20 years ago by financial guru Dave Ramsey, before smartphones and contactless payments.

Despite being outdated and at times inconvenient—some businesses refuse to accept cash—the method has allowed Griner to save $7,500 to finance her education.

Taylor, too, saw immediate results. She pays 95 percent of her expenses in cash, got rid of $32,000 in student debt, $8,000 in credit card debt and $5,000 in health care debt.

Economic downturn

Racking up debt is a national affliction in a country with abundant credit card offerings that goad households to take on more and more loans.

For Priya Malani, founder of Stash Wealth, a financial advisory service for young professionals, the economic downturn plays a role in the current success of the envelope system.

“With so many insane headlines—crypto crashes, market pullbacks, looming recession, the list goes on—it makes sense that people are looking for a little more control,” Malani said.

But Jason Howell, a wealth management professor at American University, warned that “2023 is probably the worst time to keep your cash in your house” because it earns no interest and depreciates.

In 2022, about four in 10 Americans said they would not make any cash purchases in a typical week, compared to only 24 percent in 2015, according to a Pew Research Center study.