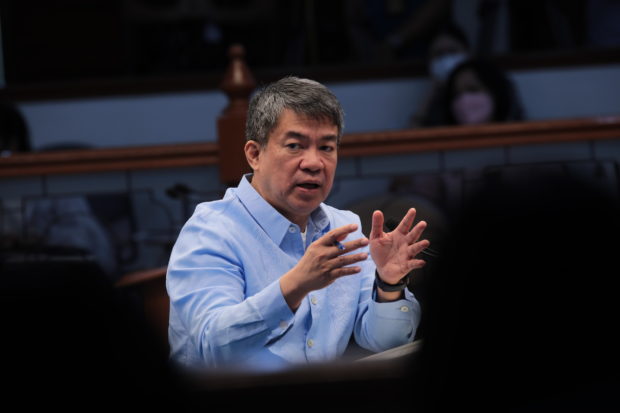

FILE PHOTO: Senate Minority Leader Aquilino “Koko” Pimentel III during a plenary session at the Senate on November 29, 2022. (Voltaire F. Domingo/Senate PRIB)

MANILA, Philippines — The potential legacy of the proposed Maharlika Investment Fund could plunge the country into debt for generations to come, Senate Minority Leader Aquilino “Koko” Pimentel III said on Thursday.

Pimentel’s remark contradicts the claim of National Treasurer Rosalia De Leon that the controversial fund will reduce the country’s debt.

“Nilagyan pa nila ng kapangyarihan si Maharlika [Investment] Corporation na mangutang. Pa’no na ngayon ‘yan? Theoretically speaking, posibleng ipamana natin ay additional utang,” Pimentel said in an online interview with reporters.

(The bill provided power to the Maharlika Investment Corporation to borrow money. How is that now? Theoretically speaking, our legacy to future generations is additional debt.)

“Kung talagang kumbinsidong itong mga nagpanukala ng Maharlika Investment Fund, bakit kailangan nila ilagay ‘yung kapangyarihan na ‘yun na mangutang sa korporasyon? Alisin nila ‘yun para makita natin how confident they are,” he added.

(If the proponents of the Maharlika Investment Fund are really convinced, why would they give the corporation the power to borrow money? Remove that and let us see how confident they really are.)

For Pimentel, De Leon’s claim is “wishful thinking.”

“Pwede na natin gamitin (We can use) wishful thinking, bluff, bluster, overconfidence,” the senator said when asked how he perceived the lower debt claim.

As of November 2022, the Philippine debt rose to P13.6 trillion.

Senate Bill No. 1670 and House Bill No. 6608, measures that seek the establishment of the Maharlika Investment Fund, were filed by allies of President Ferdinand “Bongbong” Marcos Jr.

The lower chamber already approved its version in December last year.

No justice for wrongdoers

Senator Risa Hontiveros, however, flagged that the penalties for violators of the fund’s provisions are “ridiculously low,” considering it will handle billions of pesos.

The government gets nothing from seizing illegally obtained funds – not even criminal convictions of MIC Board members will keep them out of public service forever. Even more shockingly for Hontiveros is that even a contingency plan in place in the event that money is laundered does not exist.

On the other hand, Finance Secretary Benjamin Diokno suggested that legislators should decide on whether to increase the penalty or not.