World Economic Forum projection: Debt, inflation biggest threats to PH

MANILA, Philippines—In the next two years, natural disasters and extreme weather events will be the top risks for the Philippines, which is considered as the “most disaster-prone” country in the world.

READ: No. 1 in World Risk Index 2022

This was revealed in the Global Risks Report 2023, which was released by the World Economic Forum (WEF) last week, Jan. 11. The report presented “some of the most severe risks we may face over the next decade.”

According to WEF, business leaders in the Philippines, who were part of more than 12,000 respondents for its Executive Opinion Survey (EOS), identified five risks for the country in the next two years—natural disasters and extreme weather events were considered the greatest.

The second biggest risk is a debt crisis, as reflected in the results of the EOS, which was conducted between April and September last year. The rest of the risks are rapid or sustained inflation, misinformation, and geopolitical disputes over resources.

As explained by WEF, the EOS asked thousands of respondents across 121 economies to select the top five risks from a list of 35, including prolonged economic stagnation, which was considered the greatest risk for the Philippines last year.

Looking back, the Global Risks Report 2022 stated that the top five risks for the country last year were prolonged economic stagnation, digital inequality, extreme weather events, employment and livelihood crisis, and failure of public infrastructure.

This, as it was only in 2022 when the Philippine economy started to reopen as COVID-19 restrictions were relaxed. The think tank Ibon Foundation, however, stressed that “there is far from any recovery in the sense of the economy returning to where it should have been without the protracted lockdowns.”

“It may take a decade or even more for this to happen especially with the six years of austerity to come, euphemistically called fiscal consolidation, and amid very uncertain and volatile global economic conditions,” it said.

But as extreme weather events hit the country last year, with close to 20 typhoons entering the Philippine Area of Responsibility, concerns shifted as to how natural disasters would impact the Philippines and its economy that was brought to a standstill by the COVID-19 crisis.

RELATED STORY: Sierra Madre stands up to Karding, but needs protection vs the humans it saves

Serious threat

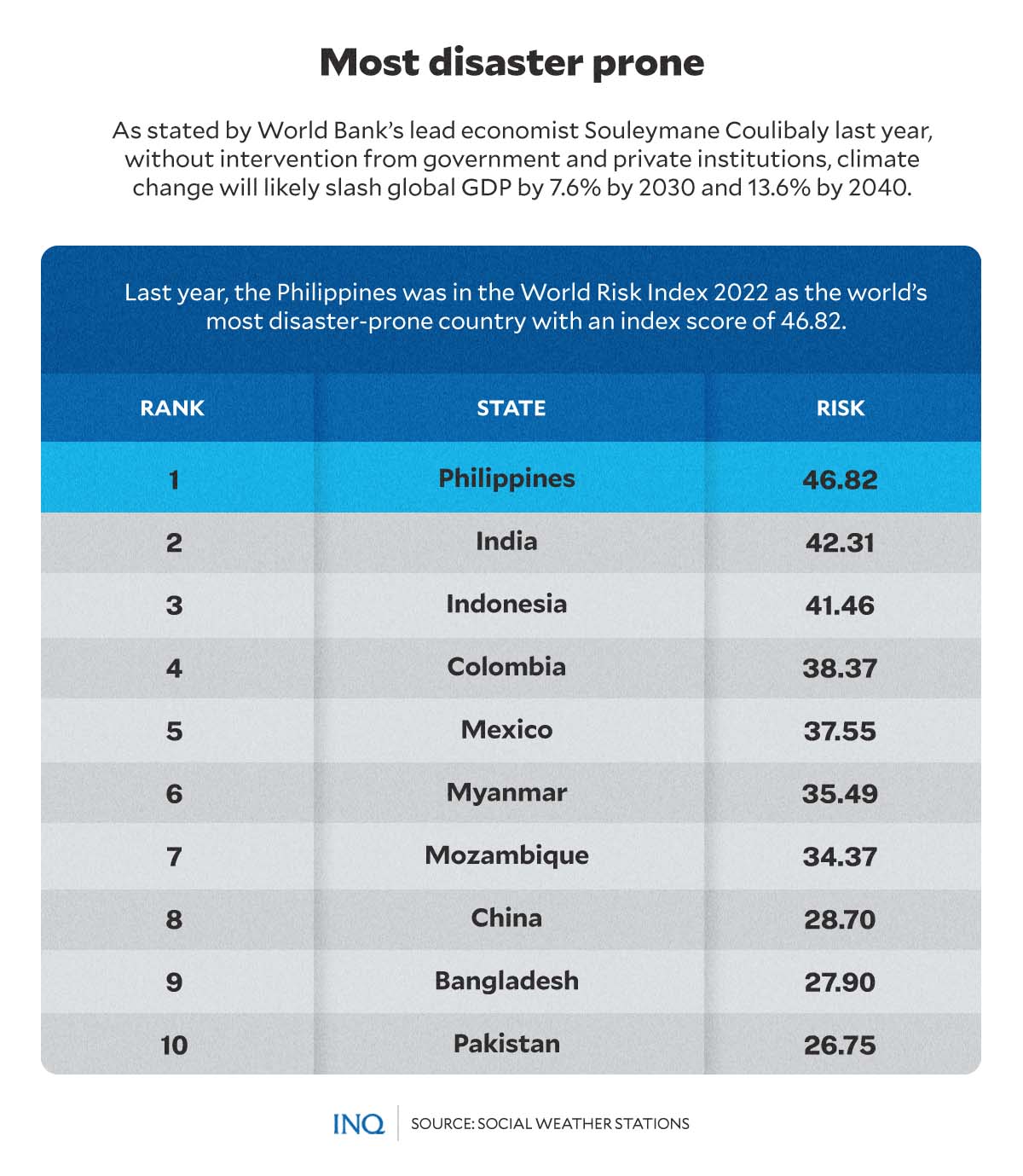

Last year, Souleymane Coulibaly, lead economist of the World Bank, said climate change, which manifests itself through rising temperatures, increasing sea levels, more intense droughts and stronger typhoons, will significantly threaten the global economy.

According to him, without interventions from government and private institutions, extreme weather events will likely slash gross domestic product (GDP) by 13.6 percent by 2040 and inflict a heavy burden, especially on the poorest of the poor.

“We have estimated that the average loss of GDP by 2030 is at least 3.2 percent rising to at least 5.7 percent by 2040. However, the impact could be much worse reaching 7.6 percent of GDP by 2030 and 13.6 percent by 2040,” he said.

Based on the World Risk Index 2022, which calculates the disaster risk for 193 countries, the Philippines, with an index score of 46.82, is the “most disaster-prone” because of high risk, exposure, and vulnerability.

READ: PH most disaster-prone country in the world—study

Next to the Philippines were India with an index score of 42.31, Indonesia with 41.46, Colombia with 38.37, Mexico with 37.55, Myanmar with 35.49, Mozambique with 34.37, China with 28.70, Bangladesh with 27.90, and Pakistan with 26.75.

“The risk assessment in the WorldRiskReport is based on the general notion that the emergence of a disaster not only depends on how severely natural hazards hit a society but also on how vulnerable society is to their effects,” said World Bank.

According to Coulibaly, the consequences of climate change are expected to negatively impact economic growth as it is seen to erode natural and physical capital, lessen work productivity, weaken financial stability, and alter domestic and external competitiveness.

He said “modeling shows that if no measure is taken to address climate change by 2040, the poverty rate will increase by nearly a percentage point, economic insecurity by 3 points and inequality by 0.3 points.”

Debt crisis?

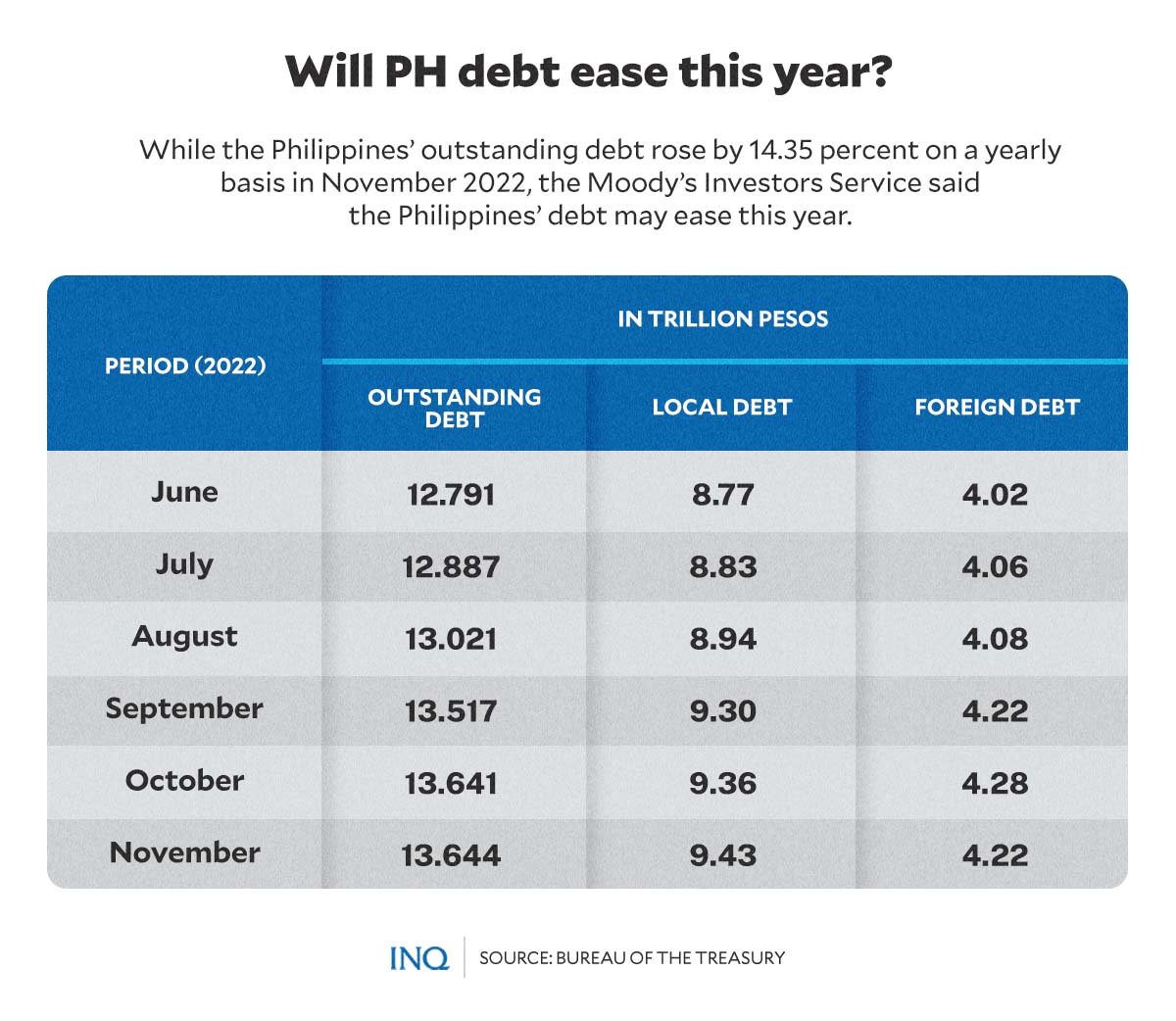

Based on data from the Bureau of Treasury (BTr), the Philippine government’s outstanding debt stood at P13.644 trillion as of end-November 2022, increasing by P3.15 billion or 0.02 percent from the end-October 2022 level.

However, the debt increased by P1.92 trillion or 16.33 percent since end-December 2021.

The BTr said domestic debt amounted to P9.43 trillion, which was P72.73 billion or 0.78% higher than the previous month’s, while external debt amounted to P4.22 trillion— P69.58 billion or 1.62% lower than the end-October 2022 level.

RELATED STORY: PH debt conundrum: Relying on consumption tax, making life tougher for the have-nots

But debt watcher Moody’s Investors Service said the Philippines’ debt may ease this year as the economy continues to recover from the consequences of one of the longest and harshest COVID-19 lockdowns in the world.

“For only a few sovereigns, including Fiji, Maldives and the Philippines, debt burdens will decline by several percentage points in 2023, driven by high nominal GDP growth,” Moody’s said last Jan. 9.

However, it stressed that “their debt burdens will still hover far above pre-pandemic levels.”

High inflation

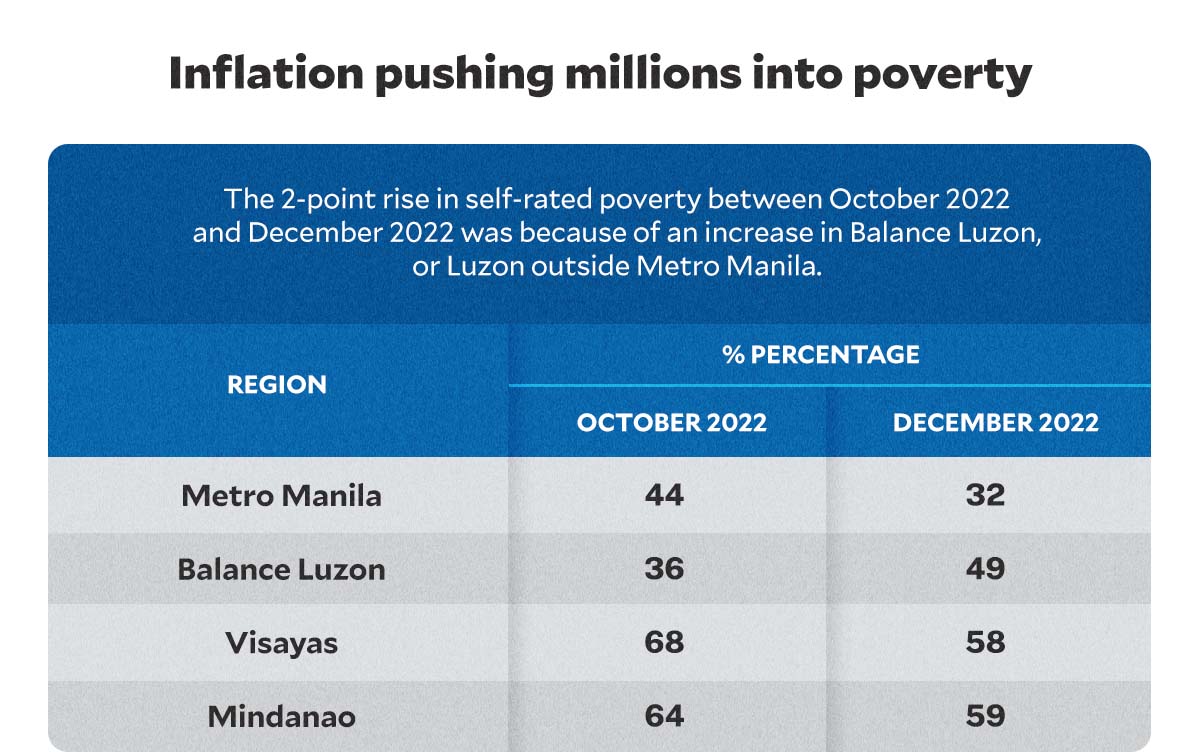

As stated in the Global Risks Report 2023, respondents also identified rapid and/or sustained inflation, which is the rate of increase in prices, as the third greatest risk for the Philippines over the next two years.

Based on data from the Philippine Statistics Authority (PSA), inflation in the Philippines went up even higher at 8.1 percent last month from 8 percent in November 2022, bringing the full-year average to 5.8 percent.

It said the inflation spike in December 2022 was mainly because of the higher annual increase in the index of food and non-alcoholic beverages at 8.4 percent, from 8.2 percent in November 2022.

This was followed by restaurants and miscellaneous goods and services index which recorded a 6.2 percent year-on-year increment in December 2022, from 6 percent in November 2022, the PSA said.

The acceleration in prices of basic goods and services weighed most heavily on poor and low-income families, especially the 18.6 million households that did not have any savings as of the fourth quarter, based on Bangko Sentral ng Pilipinas data.

But President Ferdinand Marcos Jr. said despite inflation “running rampant and out of control,” the Philippines is still on track “to maintain a strong economic performance” and achieve the government’s growth target.

READ: Marcos: Growth on track amid ‘rampant’ inflation

Greatest global risk

WEF said all over the world, the cost-of-living crisis will be the biggest global risk over the next two years as inflation is still at sky-high levels after energy and food costs spiked last year because of Russia’s invasion of Ukraine.

READ: Cost-of-living crisis biggest global risk: Davos study

“Continued supply-chain disruptions could lead to sticky core inflation, particularly in food and energy. This could fuel further interest rate hikes, raising the risk of debt distress, a prolonged economic downturn and a vicious cycle for fiscal planning,” WEF said.

“Without significant policy change or investment, the interplay between climate change impacts, biodiversity loss, food security and natural resource consumption will accelerate ecosystem collapse, threaten food supplies and livelihoods in climate-vulnerable economies, amplify the impacts of natural disasters, and limit further progress on climate mitigation.”

As stressed by WEF, the persistence of a global cost-of-living crisis could result in a growing proportion of the most vulnerable in society being priced out of access to basic needs, fueling unrest and political instability.

Some of the global risks identified, aside from a cost-of-living crisis, are natural disasters and extreme weather events, geo-economic confrontation, failure to mitigate climate change, erosion of social cohesion and societal polarization, and large-scale environmental damage incidents.

This week, thousands of government and business leaders, mostly billionaires, are in Davos, Switzerland for the WEF 2023, which is a global business forum attended by world and business leaders alike to come up with ideas and plans to address challenges facing the economy.

This year’s WEF, with the theme “Cooperation in a Fragmented World,” is the forum’s first in-person gathering since 2020.

But the WEF, which is often criticized as out of touch and an elitist gathering of the rich, is becoming “totally irrelevant,” Rana Foroohar, a Financial Times columnist, told CNN on Monday (Jan. 16).

As stated by Silvia Amaro in a CNBC article, the WEF is “an annual meeting where a global elite of business leaders, politicians and economists make bold predictions and try to set the agenda for the year ahead — but they don’t always get it right.”