Maharlika fund tweaks leave it with P110 billion

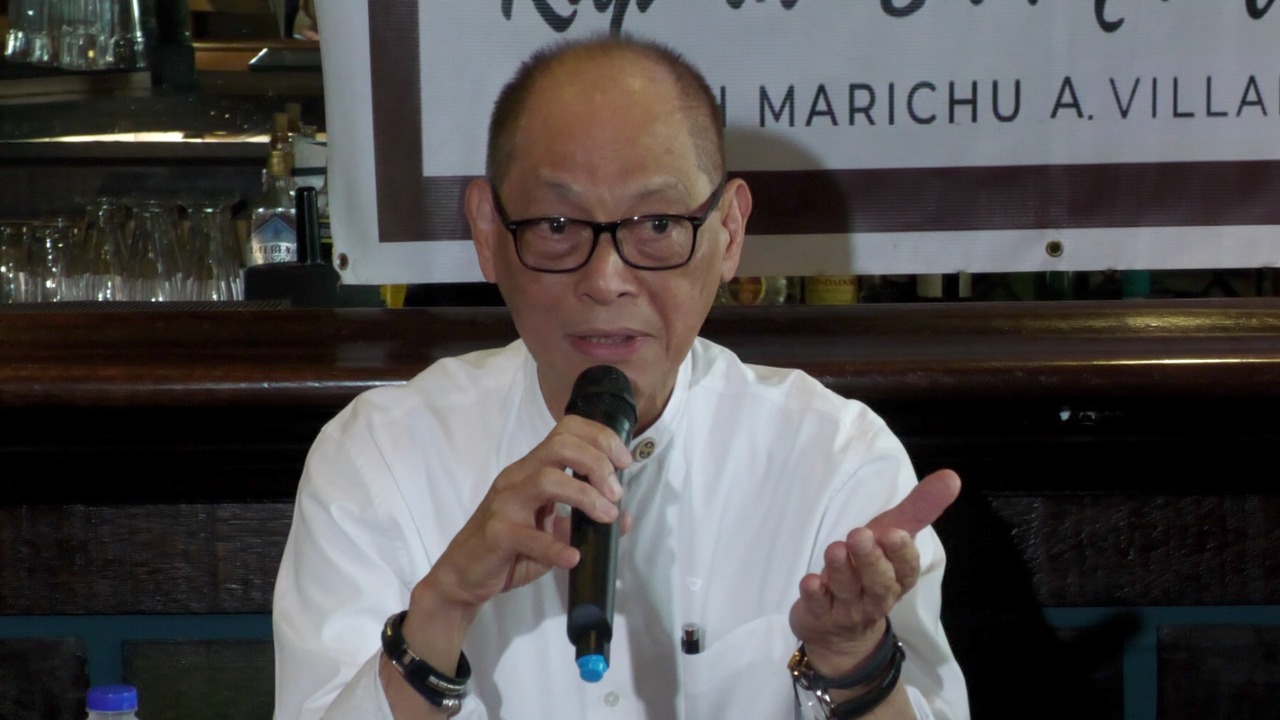

Sec. Benjamin Diokno | INQUIRER.net/Ryan Leagogo

A House panel on Friday compensated the loss of P200 billion in pension funds and the national budget from the initial funding of the proposed Maharlika Wealth Fund (MWF) with a P35-billion contribution from the Bangko Sentral ng Pilipinas (BSP).

The scrapping of the P125-billion contribution from the Government Service Insurance System (GSIS), P50 billion from the Social Security System (SSS) and P25-billion budget allocation by the House appropriations committee followed public outcry against the use of private pension funds for what critics described as a risky gamble.

The P50-billion contribution from Land Bank of the Philippines and the P25 billion from Development Bank of the Philippines will remain.

This leaves the sovereign wealth fund with P110 billion in initial funding, less than half of the original P275 billion that House Bill No. 6398 had sought.

This and other amendments to the bill creating the Maharlika Investment Fund (MIF) Corp., which would manage the MWF, were introduced by Rep. Stella Luz Quimbo, one of its coauthors.

The panel approved adding 100 percent of the declared dividends of the BSP in 2022 to the fund.

BSP lawyer Leila Rivera told the House appropriations hearing that the central bank’s dividends this year was estimated at “about P30 billion to P35 billion,” or 50 percent of its projected net income of “around P60 billion to P70 billion.”

Also approved was the BSP’s remittance of 50 percent of its declared dividends to the MWF in succeeding years, while the other half would be remitted to the national government to raise the BSP’s capitalization, which is P200 billion by law.

Once the increase in the BSP’s capitalization is achieved, it will remit 100 percent of its declared dividends to the fund.

But at a press conference also on Friday, Finance Secretary Benjamin Diokno presented a slightly different version of the BSP’s dividend contributions.

He said the BSP would contribute all of its dividends to the MWF in the first two years of the fund’s existence and then give half of its dividends from the third year until the bank reaches its capital requirement.

After that, its yearly contribution will go back to 100 percent of its dividends.

Diokno also said that the exclusion of the GSIS and SSS funds was “without prejudice for them to contribute later.”

“We are not mandating them to contribute, but if they are looking for higher returns—because right now most of their investments are in Treasury bills, from which they are not earning that much, I think—they may decide to contribute [which is a decision that is] up to their board,” he said.

Check charter

House Deputy Minority Leader Rep. Bernadette Herrera, however, expressed caution and advised the BSP to check its charter and ensure that it won’t violate the law if it commits to allocate a portion of the BSP’s dividends to the MWF.

She pointed out that the BSP needs to achieve its capitalization requirement with funding from its dividends.

“The only way a contribution to the MWF can happen is either the BSP will have enough profits in 2021 to 2022 to reach P200 billion, and anything above that can go to the MWF,” Herrera said.

“The second scenario is that they will divert the profits immediately even without reaching the P200-billion requirement, by making amendments to the law,” she said in a statement.

GOCCs to contribute

Another amendment will allow other government financial institutions and government-owned and controlled corporations (GOCCs) to also contribute to the MWF, “subject to investment and risk management strategies.”

Subsequent annual contributions will include 10 percent of gross gaming revenue streams, royalties and special assessments on natural resources, proceeds from privatization of government assets and public borrowings.

A key amendment was the replacement of President Marcos with the finance secretary, Diokno, as chair of the board of directors of the MIF Corp.

Quimbo said this proposed amendment was not tackled as it was “beyond the jurisdiction” of the appropriations committee, of which she is the vice chair, and should be decided by the House banks and financial intermediaries committee.

Diokno’s assurance

The banks panel chair Rep. Irwin Cheng said they would take it up at the “proper time.”

Addressing fears about the proposed MWF being overrun by corruption like what happened with 1Malaysia Development Berhad, or 1MDB, Diokno said Maharlika would be managed professionally.

“It is unfortunate that critics of [Maharlika] are citing that one example, Malaysia, because they have another one that works very well,” he said. “It is this corruption-laden fund [1MDB] which had no safeguards in place.”

In contrast, Diokno said, Maharlika had many safeguards and “many layers of audits” involving internal and international auditors, plus the Commission on Audit.

In addition, a congressional oversight committee consisting of five members from the Senate and five from the House will oversee the implementation of the fund, he said.

“We want to make sure that this is on the level, transparent, there is accountability,” Diokno said, adding that there would be a published report to the President.

Aside from chairing the MIF Corp., the finance secretary also sits as member of the fund’s advisory council—another safeguard—along with the secretaries of budget and socioeconomic planning, and the national treasurer.

‘Tried and tested’

A joint statement by the country’s economic managers, which includes Diokno, Budget Secretary Amenah Pangandaman, Socioeconomic Planning Secretary Arsenio Balisacan and BSP Governor Felipe Medalla, strongly supported the creation of the Maharlika fund.

“The establishment of a Sovereign Wealth Fund is a tried and tested investment vehicle that has been used by governments in both First World and developing countries to achieve their economic objectives,” they said.

The economic team added that the creation of the MWF will help the country achieve the “Agenda for Prosperity” and the objectives for inclusive and sustainable economic growth that they have outlined in the Medium Term Fiscal Framework, Eight-Point Socioeconomic Agenda and the Philippine Development Plan 2023-2028. It said direct benefits from the sovereign fund included increased investments in and funding of big-ticket infrastructure projects, high-return green and blue projects, and countryside development.

Intergenerational benefits include increased access by future generations to income from investments, such as potential earnings from extracted natural resources, such as in mining, the statement said.

In a Dec. 2 interview with Bloomberg TV, Medalla said he was wary of Malaysia’s experience with 1MDB, noting that even if current fund administrators were good people, it could not be assured that subsequent officials would be good as well.

He was also concerned that the BSP’s independence would be compromised, especially if it was required to channel its foreign reserves into the fund.

“But I’m a law-abiding person. If the law says we will, we will,” Medalla said.

‘Trust, timing issues’

Go Negosyo founder Joey Concepcion said that if the sovereign wealth fund addressed the “trust and timing issues,” it could present “vast investment opportunities” for the country.

“Done properly, I think it’s a good idea,” he said on Friday. “It should be managed by the private sector, and then we will see the level of trust move up,” he added. “Right now, it is not clear how the fund will operate. But if you want the people’s buy-in with this fund, you should assure them that it will be run by people who have no conflicts of interest and are very capable of turning in a profit for the fund,” Concepcion said.

RELATED STORY:

House drops GSIS, SSS from Maharlika fund plan