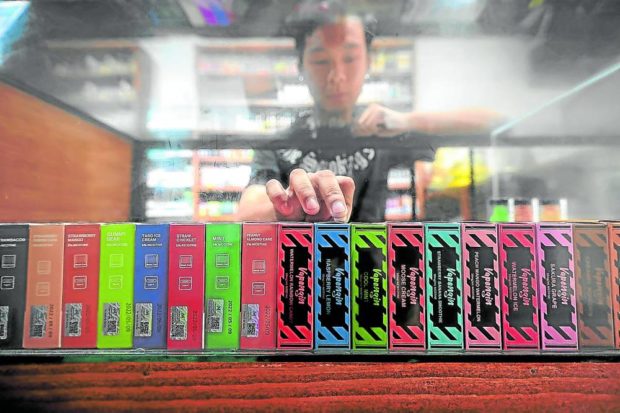

SMOKING ALTERNATIVE A vape shop assistant arranges vape juice on its shelf at a shop along Kamias Road in Quezon City. —INQUIRER FILE PHOTO

MANILA, Philippines — A lawmaker demanded that the Department of Trade and Industry run after untaxed, imported vaping products that are being passed off as “toys” and “electronics” on online selling platforms.

Albay Rep. Joey Salceda, chair of the House ways and means panel, on Friday slammed the “lax compliance” with Republic Act No. 11900, or the Vaporized Nicotine and Non-Nicotine Products Regulation Act.

In a statement, the economist-turned-lawmaker said his congressional staff did a simple search of online selling platforms, like Lazada, to check how easy it is to buy vape without the age tests, the requirements for graphic health warnings and other legal specifications.

‘Very easy to buy’

“It turns out, it’s very easy to buy vape without any of these requirements,” he said, adding that there are some online sales of vaping products “that are not even branded” and some online sellers avoid paying excise taxes on by categorizing these as mere toys and electronics.

“Advocates of the vaping regulation law argued that it was a better way to regulate the sector and supposedly save lives. It also provided rules on the sale of vape online. Let’s prove it,” he said.

The lawmaker also urged the Bureau of Internal Revenue (BIR) to create regulations to fight counterfeit vaping products and ensure that excise taxes are imposed on imported vaping products.

“The BIR should impose some degree of accountability on online shopping networks that they are aiding and abetting tax evasion if they sell products that do not comply with excise taxes. I would like rules ensuring that vape is categorized as a restricted product, not as toys or electronics in online shops. That will also help prevent tax evasion and marketing to minors,” Salceda said.

Exclude from de minimis

He cited the “de minimis” rule in RA 10863, or the Customs Modernization and Tariff Act, which states that goods under P10,000 are subject to no duties and are inspected less stringently.

The Bureau of Customs, he said, should exclude vaping products from the de minimis rule, saying this is for “generally benign imports.”

“The de minimis rule excludes plenty of products with adverse impacts on health. Vape products are no different,” Salceda said.

He also noted that some vaping companies resort to a “blatant and contemptuous way” to appeal to younger people by making vaping devices look “generic-looking, but they wrap them in cases that feature cartoons.”

RA 11900 states that vaping devices should not be targeted to appeal to persons under 18 years old, and that the use of images, like cartoons, anime manga and other youth influencers are prohibited.