Europe would struggle to refill gas storage without Russian supplies

3D printed Natural Gas Pipes are placed on displayed EU and Russian flags in this illustration taken, January 31, 2022. REUTERS FILE PHOTO

LONDON/OSLO — Europe’s plans to build stocks and ensure gas supplies for next winter could be upended if exports from Russia are halted in a standoff over payment terms, risking curbs on industrial use, analysts warned.

Russia typically provides Europe with around 40% of its gas but the possibility of supply disruption since Moscow’s invasion of Ukraine has increased over the past week, with G7 nations rejecting a demand for payment in roubles.

The European Commission says gas held in storage typically accounts for around a quarter of that used in Europe over the winter months, where it is a major heating fuel.

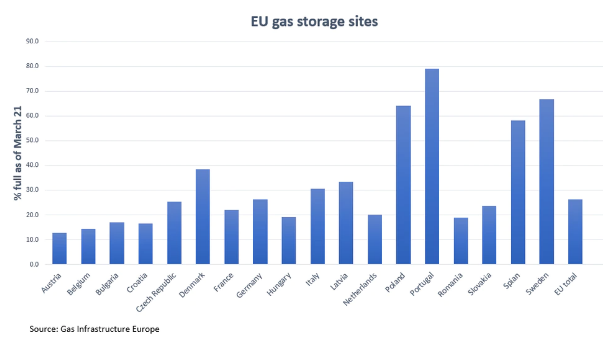

In a bid to shore up supplies for next winter it has proposed legislation compelling gas storage operators to fill sites to at least 80% of capacity by Nov. 1.

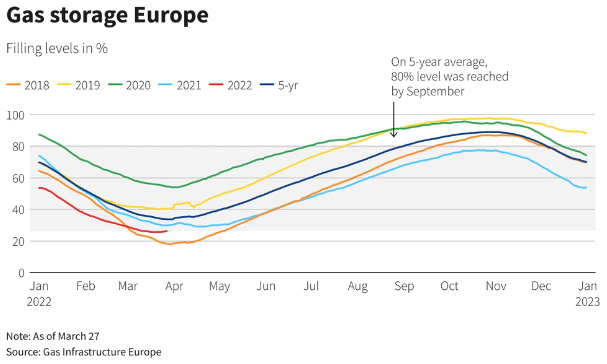

But with stores currently only around a quarter full, and below the five-year average for the time of year of just under 34%, the task looks incredibly difficult to meet without Russian supplies.

Article continues after this advertisement“The target of 80% by Nov. 1 is achievable as long as at least some Russian gas continues to flow,” said Jack Sharples, a Research Fellow at the Oxford Institute of Energy Studies. “But I think that in terms of doing it without Russian gas, it’s just not feasible.”

Article continues after this advertisementGermany, Europe’s largest gas consumer which relies on Russia for around half of its needs, has set a target of 90% by November. It’s gas stocks are currently 26% full.

But in an unprecedented move, the country on Wednesday also triggered an emergency plan that could see the government ration power if Russia gas supplies are disrupted or halted.

The European Commission said immediate supply emergencies would take priority over refilling storage, with targets not applicable if it declares an EU-wide or regional gas supply emergency – which it can do if at least two countries have already issued their own declarations.

“If Russian flows stop tomorrow and then don’t restart until next winter or for the whole year or more, then storage will not be able to fill to the 80% level,” said Kateryna Filippenko, Principal Analyst, Global Gas Supply at Wood Mackenzie.

“Most likely in the EU storage will end up somewhere slightly over half, maybe around 54%.”

This, Filippenko said, could pose problems for industry as Europe would seek to shield vulnerable consumers by curbing industrial gas use, potentially by as much as a fifth.

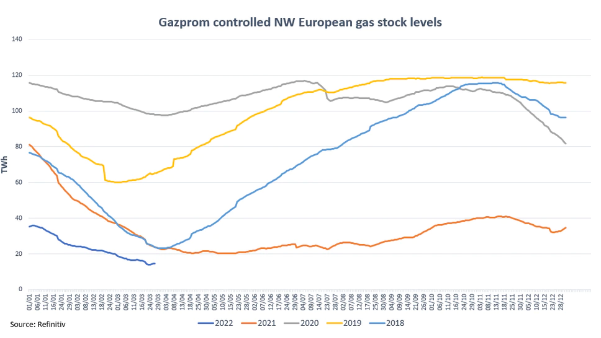

The storage plan is further complicated by Russian state-owned gas company Gazprom’s (GAZP.MM) control over several northwest European storage sites, where stocks are at the lowest in at least 5 years.

In Germany, a third of gas storage belongs to Gazprom (GAZP.MM).

“We think Gazprom is unlikely to try to fully refill these sites given progressively lower contractual demand for Russian supply and little appetite for Gazprom to sell on the spot market,” said Leon Izbicki, Associate, European Natural Gas at Energy Aspects.

If faced with the risk of shortages, German law allows Trading Hub Europe (THE), a gas market hub overseen by the country’s energy regulator, to use storage facilities that are empty or below stipulated filling levels to store its own purchases.

“Market managers such as THE are likely to take this space under the ‘use it or lose it’ principle…and fill this capacity,” Izbicki said

The European Commission has also proposed that from 2023 all gas storage sites should be 90% full by November 1.

The EU is aiming to cut its dependency on Russian gas by two-thirds this year and end all Russian fossil fuel imports by 2027.

RELATED STORIES

Factbox: When have the United States and others previously released oil from reserves?

Eking out an existence and mourning the dead in besieged Mariupol

Ukraine preparing for new Russian offensive in the east, Zelensky says

Pentagon sees Russia starting to reposition under 20% of forces around Kyiv