Guidelines for anti-money laundering law sought to avoid ‘grey-list’

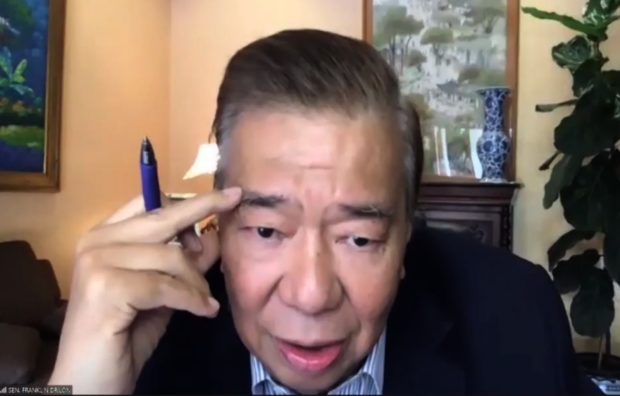

GREY LIST THREAT: Senate Minority Leader Franklin Drilon points at the regular threats issued by the Financial Action Task Force to the Philippines on the issue of compliance with anti-money laundering regulations during the virtual hearing of the Committee on Banks, Financial Institutions, and Currencies, Wednesday, October 28, 2020. Screen grab/ Senate PRIB

MANILA, Philippines — Two senators on Wednesday asked the government to provide the guidelines from the Financial Action Task Force (FATF) with regards the needed amendments for the Anti-Money Laundering Law.

During the hearing of the Senate committee on banks, financial institutions and currencies, Senator Grace Poe sought clarification about the Philippines’ rate of compliance to FATF’s recommended actions with regard to the country’s anti-money laundering and counter-terrorism financing measures.

Poe asked this as fresh amendments are sought to the Philippines’ Anti-Money Laundering Law amid threats of the country being placed under FATF’s “grey list” which could have repercussions to the national economy.

In the website of the FATF, a country or jurisdiction placed under its “gray-list” means “it has committed to resolve swiftly the identified strategic deficiencies within agreed timeframes and is subject to increased monitoring.”

Any of the resource speakers present, particularly the AMLC, was not able to respond.

Senate Minority Leader Franklin Drilon backed Poe’s question, saying that the government would usually get notices from the FATF regarding the matter.

Drilon was the Senate President when the original version of the country’s Anti-Money Laundering Law was passed 20 years ago.

“Regularly, we would get notices from the FATF saying that unless you do these things, you’ll be in the grey list and the threat of being in the grey list carries the threats on making remittances of our OFWs more difficult, in other words the vulnerability of our system to maintaining a good remittance system is being constantly put in issue,” Drilon explained.

It was here that Drilon started questioning if the government has any documents to rely on with regard to the country’s standing with the FATF.

“As I repeat, we have constantly been threatened, I think it’s the right [term] for lack of any — we have been threatened with sanctions. And we have constantly complied with these advices,” Drilon said.

“My question is, ano pa ba ang dapat nating gawin, bakit regularly merong binibigay sa atin na mga pangangailangan na gawin in order that we can be taken off the grey list. In other words, do we see the light at the end of the tunnel when we are completely free from these regular threats? What will it take, will this be the last time that this will happen?” he added.

Poe echoed Drilon’s line of questioning, saying that the country’s Anti-Money Laundering Law was just amended in 2017 or merely three years ago.

“Are these carry-over from previous evaluations? Are there new deficiencies. Because before we craft another amendment, we should have these guidelines in place so that we don’t have to keep updating the law,” Poe said.

“We just had one in 2017, we’re having one again now. So AMLC I’m surprised that you didn’t respond immediately earlier regarding our question as Sen Drilon noted, we usually receive notices,” she added.

Effect to economy, OFWs

In the same hearing, AMLC Secretariat Executive Director Mel Georgie Racela explained that a country’s inclusion in the FATF’s grey-list due to deficient anti-money laundering measures could lead to higher remittance cost for overseas Filipino workers (OFWs).

Racela said that the Philippines has to demonstrate “tangible progress” to avoid being grey-listed.

This includes the implementation of new laws and regulations in relation to anti-money laundering and counter-terrorism financing.

“If we fail to demonstrate positive tangible progress, the Philippines will be placed in the grey-list. This will have a negative impact on our country and the lives of Filipinos working abroad, particularly overseas Filipino workers and their families,” Racela said.

“For OFWs, higher cost of remittance means less money for food, shelter, and education and other basic necessities of their families,” he added.

Racela likewise said that higher remittance costs may also lead to a decline in inward remittances and the country’s gross domestic product.

Being placed in the grey-list, Racela said, also has other implications such as follows:

- Countries will impose enhanced due diligence on Filipino nationals and businesses which means additional costs and delays in transactions;

- For Philippine businesses, this means higher interest rates and more expensive production costs;

Investor and lender confidence may be reduced; - Timeline to achieve the “A” credit rating may be prolonged;

- The Philippines will be included in the European Commission’s “EU List of High Risk Third Jurisdictions”

“In such case, all EU members are mandated to impose enhanced due diligence on Philippine nationals and businesses as well as prohibit persons implementing financial instruments or budgetary guarantees from entering into new or renewed operations with persons from the listed countries,” Racela said.

President Rodrigo Duterte earlier certified as urgent the bills that seek to strengthen the country’s anti-money laundering law.