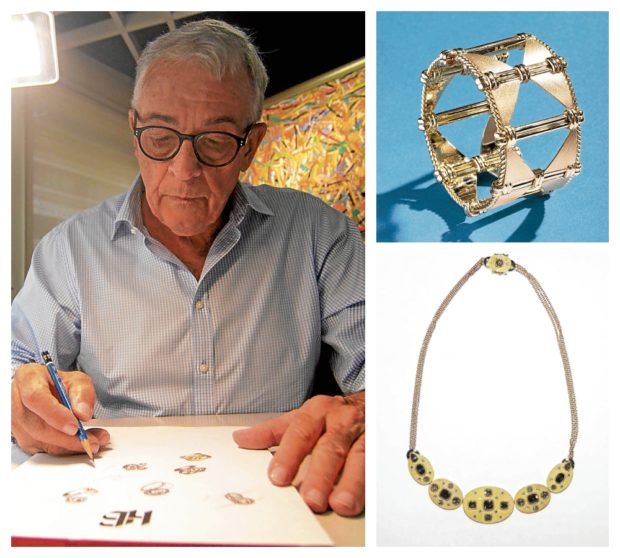

SHOWPIECES “Gold has a future because it is rising so fast,” said Swiss jeweler and goldsmith Hans Brumann, who has been designing jewelry for the Philippine chi-chi set since the 1960s. He cites the appeal of this investment to all sectors except millennials. He is shown in this 2016 photo at work with his designs. Among the pieces he has made are (top right) an 18-karat yellow gold bangle bracelet and (right) an 18-karat yellow gold neckpiece studded with 12.78-carat brown diamonds and 0.62-carat cut diamonds. —PHOTOS OF JEWELRY COURTESY OF HANS BRUMANN

MANILA, Philippines — One of Manila’s most popular jewelry designers is confident that gold remains a wise investment because its price continues to rise in the international market.

But convincing Filipinos to buy gold in these troubled time of the new coronavirus is another matter, said Swiss jeweler and goldsmith Hans Brumann, who has been designing showpieces for the Philippine chi-chi set since the 1960s.

“In one year, the price of gold has gone from $1,300 an ounce to $2,200. (Brumann cited the mid-August gold price in this interview. An update from his office on Friday said it was $1,940 an ounce.) And experts are saying it could go higher…Gold has a future because it is rising so fast,” he told the Inquirer in an interview in his Makati atelier.

Brumann’s job requires him to observe Filipinos’ behavior when it comes to buying jewelry, and he notes that even those who do not belong to the market to which he caters make an effort to buy gold when they can.

“Especially in the Philippines, even among poor people, the maids buy jewelry in gold,” he said.

Many Filipinos buy gold jewelry as an investment to be passed on to their children. In times of emergencies, such as the government-imposed lockdown in effect since March, many owners of gold jewelry have trooped to pawnshops with their pieces for “safekeeping” in exchange for cash that would be later paid back with interest.

Big market

In the case of Brumann’s clients, jewelry is also passed on to the next generation. Or returned to his atelier by the recipient to have the gold melted and the setting redesigned into something more modern. (Stories of jewelry sold or pawned to trusted parties in this rarefied set are told in whispers, if at all.)

“You can melt the gold and the value is still there. So there is always a big market. People come here to have the gold redesigned and it becomes something new,” he said.

Brumann has a habit of buying gold “constantly” for made-to-order pieces crafted in his workshop. But the lockdown imposed to halt the spread of the coronavirus has adversely affected sales in his two shops in Makati City.

“I am now stuck with a lot of jewelry,” he said. “I have a client who has been with me since the 1980s. I have an order from her, waiting here since 2019. She cannot pick it up because her children would not let her leave the house until a [COVID-19] vaccine is found.”

But he can still rely on his regular clients for a steady stream of orders. “Given the character of my clients, they cannot be without jewelry,” he said.

Brumann is more concerned now about convincing younger people to invest.

Millennials, he noted, are more enamored with brand name trinkets endorsed by Hollywood stars and sold in high-end malls. These could sometimes cost as much as real gold jewelry in 14- or 18-karat gold.

Silver alloy

“But these are made of silver alloy, or are only gold- or rhodium-plated to make the metal look like genuine white gold,” Brumann cautioned.

He added: “And the stones are not diamonds but [synthetic stones]. They are very popular in Europe and the US. These are only fashion accessories. So you’re just buying into the trend.”

“Maybe there’s value in the design but [none in] the materials.”

There have been cases of people being turned away at pawnshops, surprised to learn that these pieces are not as valuable as they thought.

International standards measure gold in karats. Fine or pure gold is 24 karats. According to Brumann, this is often mistakenly referred to as “Chinese gold.”

But since gold is a soft metal, it needs an alloy, usually a smaller amount of another metal, to make it more durable.

Hence, 18-karat gold has 18 parts gold and six parts metal alloy. Fourteen-karat gold has 14 parts gold and 10 parts alloy.

High-end global brands like Tiffany and Cartier use 18-karat gold and prove this by stamping a discreet portion of their jewelry with “.750,” to indicate the 18/24 karat ratio, Brumann explained.

There is also a “hallmarking” to reveal the jewelry firm responsible for the gold content, he added.

So-called “Saudi gold” is usually 18 karat, Brumann said. “But this kind of jewelry actually comes from Italy where it is machine-made. Then sent to the Middle East and bought by a lot of our OFWs,” he added.

Fourteen-karat gold that is more popular among local jewelers should carry “.585” in their product to mean a 14/24 gold ratio, Brumann said.

“But in the Philippines, the jewelry is not usually stamped. There is no agency that checks because either there is no law or it is not being observed. In Europe, you will be fined if you do not carry the hallmark. My products have a hallmarking and a stamp of .750,” he added.

Gold or gold-plated?

Buyers and some pawnshops have a method of checking whether a piece of jewelry is really made of gold, or is only gold-plated.

Brumann said he was familiar with this process: A hidden portion of a gold piece is rubbed against a smooth black stone about the size of a paperweight and called streak or touchstone. A very small amount of nitric acid is then applied, often with a dropper, to the sediment.

Jewelry of varying amounts of gold react differently to the solution.

But jewelers and pawnshops are hesitant to disclose the results they require to assess authenticity.

Brumann also noted that young people are not keen on buying fine gold jewelry.

“The price of gold is going up but it is not easy to predict who our next clients will be. How do the young think about jewelry? Why would they buy it instead of investing in an apartment?” he said.

Brumann’s solution is to offer more affordable 14-karat jewelry in rhodium-plated white gold that looks like the more expensive 18-karat pieces sold in his shops.

“Fourteen-karat yellow gold does not look as good as 18-karat yellow gold. But white gold, whether 14-karat or 18-karat, looks the same when rhodium-plated,” he explained.

“So we make jewelry more affordable for the middle class. In white gold. I am still positive about the future. But it all depends on how the [new coronavirus] behaves. What if it stays longer than we think?” Brumann said.