MANILA, Philippines — The House tax-writing panel on Monday approved a bill imposing a 5-percent franchise tax on offshore gaming companies and a 25-percent withholding tax on their mostly Chinese workers, a measure that’s projected to generate P20 billion to P45 billion in additional revenue for the government.

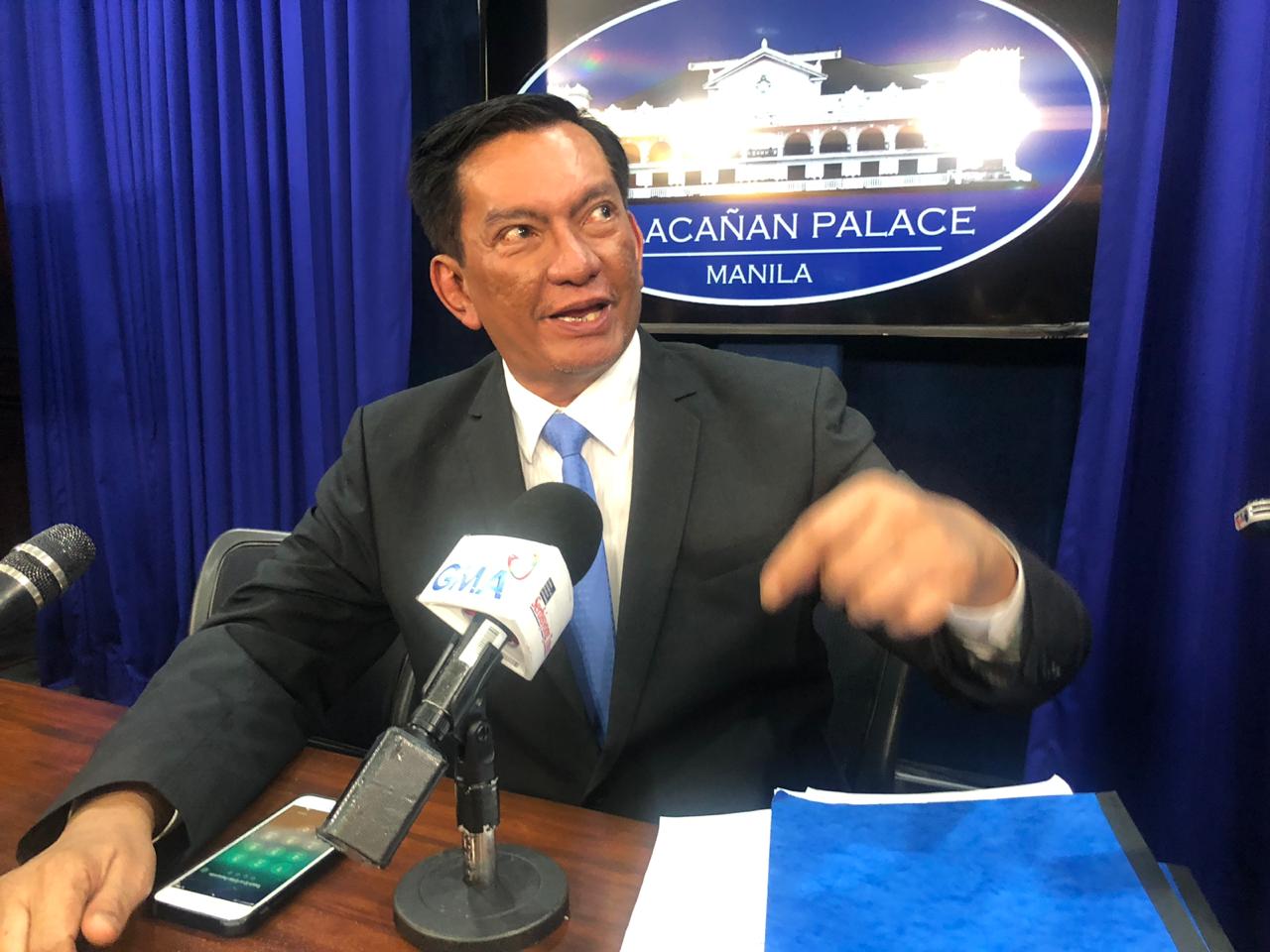

Crossing party lines, members of the ways and means committee led by Albay Rep. Joey Salceda unanimously endorsed House Bill No. 5267 for consideration of the 300-strong chamber.

The bill will then be tabled for debate in plenary session.

Salceda’s bill hurdled the committee as President Duterte’s economic team disputed the view of Solicitor General Jose Calida that the government cannot tax Philippine offshore gaming operators (Pogos) as the income of these companies does not come from the Philippines.

BIR’s jurisdiction

Finance Secretary Carlos Dominguez III, the economic team’s head, said “the primary jurisdiction to interpret tax code provisions lies with the Bureau of Internal Revenue (BIR).”

“The BIR issued an opinion to this effect months ago, saying that the situs of income is where the services are rendered,” Dominguez told reporters on Viber.

“Thus, since Pogos are providing services to their counterparts in the Philippines, they are subject to income tax,” he said.

“The same is true for value-added tax, which is also imposed on services rendered in the Philippines,” he added.

The BIR issued regulations in 2017 imposing taxes on Pogos to reduce the government’s forgone revenue from these businesses.

Revenue Commissioner Caesar Dulay also issued special rules that required Pogos to register with the BIR before they could renew their Philippine Gaming Corp. (Pagcor) licenses.

Not national policy

Officials of the National Economic and Development Authority (Neda) led by Socioeconomic Planning Secretary Ernesto Pernia also rejected Calida’s view during budget deliberations at the Senate on Monday.

Speaking on behalf of Neda as sponsor of its budget for 2020, Sen. Juan Edgardo Angara said the government’s economic managers did not share Calida’s opinion and that they would ask the state’s top lawyer to overturn his own stand.

“They don’t agree with it. In fact, they are trying to tax that sector,” Angara told Senate Minority Leader Franklin Drilon, who had asked the Neda officials if they agreed with Calida.

“So this is not correct as a matter of policy, that Pogos cannot be taxed?” Drilon asked.

Angara replied: “I was told by Secretary Pernia that it’s not the national policy … They will discuss that with (Calida) because they have conflicting opinions. They will appeal it.”

Among other provisions, Salceda’s bill amends the National Internal Revenue Code of 1997 by imposing a 5-percent franchise tax directly on gross receipts of Pogos licensed by Pagcor.

Withholding tax

It also levies a 25-percent withholding tax on Pogo workers earning at least P600,000 a year, and authorizes Pagcor to issue Pogo licenses upon registration with the BIR, Salceda said.

“This will raise P45 billion for the national government,” he said.

According to Pagcor, there are only 60 licensed Pogos operating in the Philippines. But Salceda said only 10 of those were paying taxes to the BIR.

The Albay lawmaker also disputed Calida’s opinion, arguing that the thousands of Chinese mainlanders now working in Pogos in southern Metro Manila “proved” that the companies were earning local revenue.

Salceda cited a basic accounting principle in refuting the position of the Office of the Solicitor General (OSG): “Costs are recognized when revenues are recognized. So aren’t the wages here costs expensed by Pogos?”

Chinese working here

“At least 138,000 mainland China workers roaming in Pasay, Las Piñas and Parañaque working for Pogos prove that these firms are operating inside Philippine territory and are deriving income from it,” Salceda said.

He said the 119,000 alien employment permits and special working permits issued by the Department of Labor and Employment to Chinese nationals provided supporting evidence to his argument.

“The bets are made by people outside the Philippines but is enabled by manpower and facilities inside the Philippines. So there is value added or income derived here, therefore taxable,” he said.

In separate letters in December and January, the OSG told Pagcor and the BIR that Pogos cannot be taxed because the earnings of these companies primarily come from bets placed by gamers overseas.

“Ultimately, an offshore-based operator’s income is the placement of bets on its online betting facility, which are derived from sources [outside] the Philippines,” Calida said in one of the letters.

But Salceda said the OSG’s interpretation “rises to the level of a tax exemption, the grant of which is intrinsically the duty of Congress.”

The more pressing issue, according to him, is that Pagcor merely charges a 2-percent regulatory fee on Pogos instead of a 5-percent franchise tax, in lieu of other taxes.

“They (Pagcor) collect P8 billion per year from this 2 percent and propose to remit P400 million,” Salceda said.

Under his proposal, “instead of remitting P400 million to BIR, they remit P20 billion,” he said.