Bill exempts common motorcycles from road user’s tax, gradually hikes rates for other vehicles

MANILA, Philippines — A bill that will exempt common motorcycles from the motor vehicle road users’ tax (MVRUT) and gradually increase rates for other vehicles was filed at the House of Representatives to fund the Duterte administration’s Universal Health Care (UHC) and the Public Utility Vehicle (PUV) modernization program.

Albay 2nd District Rep. Joey Salceda filed House Bill No. 4695 or the “Motor Vehicle Road User’s Tax Act” last Sept. 18. Section 5 of the bill mandates that half of the revenues from the measure was earmarked for the implementation of the UHC, and the other half for the PUV modernization program.

Since the bill both “generates revenue and enhances progressivity,” Salceda said the measure is expected to yield P8.12 billion in 2020, P9.62 billion in 2021, P10.57 billion in 2022, P28.44 billion in 2023, and P32.61 billion in 2024 for the government.

Salceda said his version is different from the Department of Finance’s Package 1C of the comprehensive tax reform program which proposes a unitary rate based on weight for all vehicles, private or government and for-hire vehicles. Despite this, he said he is open to revising his bill, as he assured that he would consult all relevant stakeholders of the measure.

“The original proposal of the Department of Finance was a drastic shift to unitary rate. Ayaw po nating mabigla ang motoring public,” the House ways and means panel chair said in a statement.

“Ito pong bill ko, una, phased ang increase for 3 years. Sa 2023 lang po papasok ang unitary rate of P1.40 per kilogram of gross vehicle weight for all types of motor vehicles. Indexed na po na 5 percent increase every year after that, para hindi na natin kailangang gumawa ng batas taon-taon para lang i-update ang rates,” he explained.

Article continues after this advertisementAlthough road users in the Philippines have increased significantly over the past decade, Salceda said the motor vehicle user’s tax, a license and renewal fee paid by vehicle owners for road construction and improvement, has not been updated since 2004.

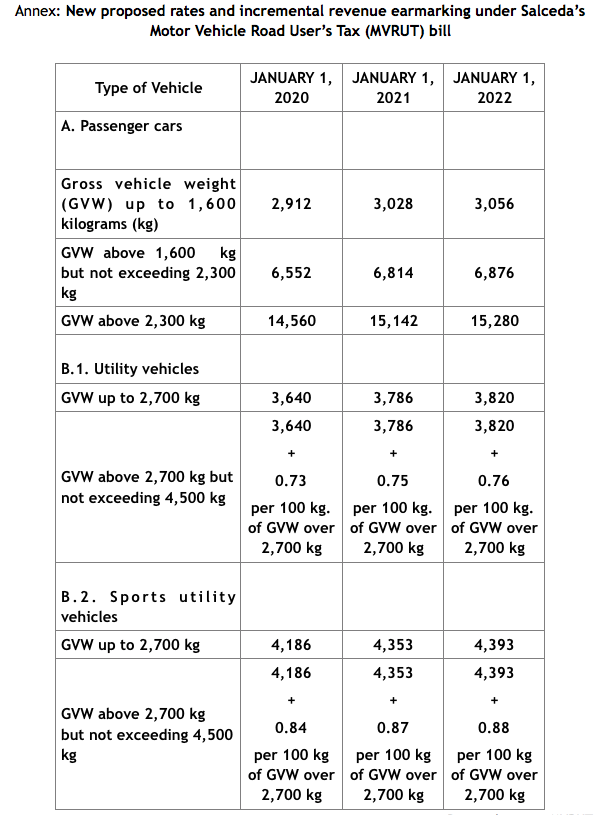

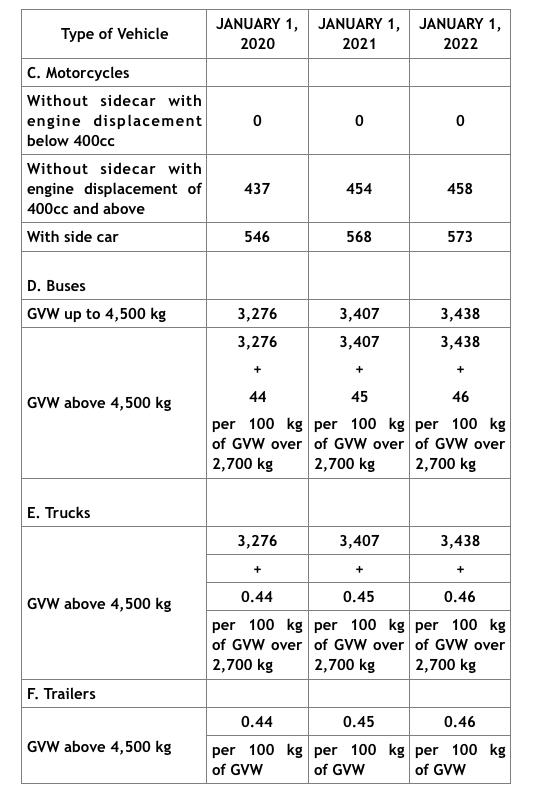

Article continues after this advertisementHB 4695 specifically proposes the following road users tax rates for passenger cars, utility vehicles, sports utility vehicles, buses, trucks and trailers, and motorcycles with sidecar and engine displacement of 400cc and above:

By Jan. 1, 2023, all types of vehicles would be charged P1.4 per kilogram of gross vehicle weight, under Salceda’s proposal. The rates would then increase by 5 percent annually, starting Jan. 1, 2024.

Exempted from the charge are motorcycles without sidecar and with an engine displacement of below 400cc.

“It [the bill] provides relief for motorcycle owners, who, because of traffic, have been forced to use motorcycles. These people are not rich, and cannot afford cars. Actually, there are more motorcycle owners than there are owners of all other vehicles under MVUC combined, so this will also reduce bureaucratic strain,” Salceda said./ac