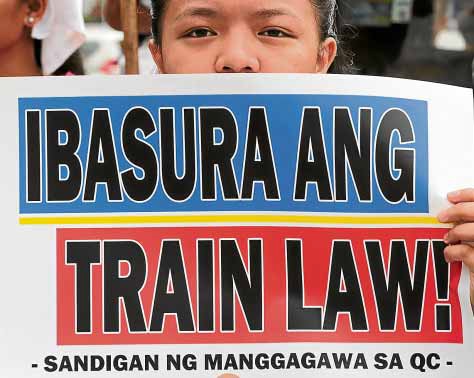

CONSUMER FOE An activist holds a sign demanding the scrapping of the TRAIN law, which is being blamed for rising consumer costs. —GRIG C. MONTEGRANDE

Reducing excise on petroleum products will require legislation, as it is not provided in the Tax Reform for Acceleration and Inclusion (TRAIN) Act, according to a finance official.

Assistant Finance Secretary Joselito Lambino II made the clarification in a press briefing in Malacañang on Tuesday when asked to comment on calls to cut the amount of taxes on fuel to stem inflation.

“There is no provision under the law for the rollback of the current excise tax [on petroleum products],” Lambino said.

“That would need congressional action,” he added.

Lambino made the remarks following the Department of Finance (DOF) announcement that the next round of fuel taxes in January 2019 would be suspended to ease inflationary pressure.

Conditions

The existing excise rates for fuel products are P2.50 per liter of diesel and P7 per liter of gasoline.

The second tranche of fuel taxes would have increased the levy to P4.50 for diesel in 2019 and P6 per liter in 2020.

For gasoline, it will climb to P9 in 2019 and P10 in 2020.

Under the TRAIN law, fuel taxes may be suspended if global crude prices stay at $80 per barrel for three consecutive months.

Lambino, however, said the suspension of fuel taxes was likely to push through because of gas prices in the world market and other conditions.

Consumer behavior

Lambino said although suspending fuel taxes “won’t do much in itself,” the “anchoring of those inflationary expectations is also very important.”

“We know that when people think that prices will spike, they will buy in bulk if they have money, putting upward pressure on prices because of the demand side push,” he said.

“We want our countrymen to know that we are doing all we can to lower upward pressure on prices, so it will lead to behaviors that will help us manage our economy in the best way possible,” he added.

Lambino also reiterated the DOF’s position that the government was expecting P41 billion in foregone revenue if the second tranche of fuel taxes was suspended.

Goodbye P41B?

“The forgone revenue estimated for the second tranche is P40 to P41 billion, but it’s still early to be able to tell exactly,” he said.

Lambino said this meant that the government might have to cut back on its noninfrastructure expenses like social programs, since it intended to maintain the current level of expenses on public infrastructure.