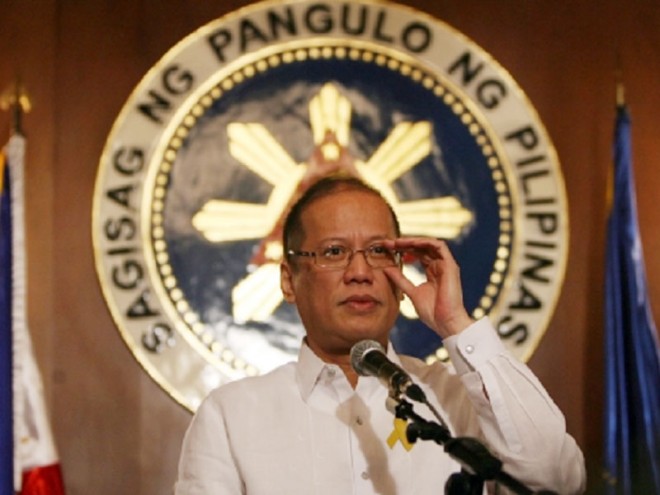

Aquino meets with Angara, Quimbo to discuss income tax cuts

President Benigno Aquino III has met with the main proponents of the bill that aims to lower income tax rates, a Palace official said on Saturday.

Deputy Presidential spokesperson Abigail Valte said Aquino met with senator Juan Edgardo “Sonny” Angara and Rep. Romerico “Miro” Quimbo.

“The President sat down with them and was able to hear out their proposals,” Valte said, adding that the President has instructed the Department of Finance to continue studying the proposals of the two legislators.

She said that Aquino’s meeting with the two lawmakers was “a good starting point” as far as the merits of the proposal were concerned.

Aquino earlier said that he was not keen on lowering income tax rates.

“The question is, will lowering the income tax rates benefit our countrymen?” “I’m not convinced it would,” Aquino had said in Filipino.

He said he favored the status quo, which means the government would not lower income tax rates but would not raise the 12-percent value-added tax (VAT) on goods and services either.

READ: Palace sticking with status quo, not proposing income tax cut | Aquino urged to lower individual income taxes as ‘best goodbye gift’

House Speaker Feliciano Belmonte said that the bill seeking to lower income tax rates would not be possible in the 16th Congress. IDL