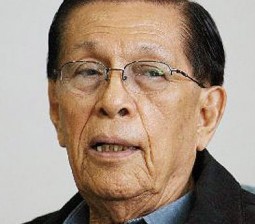

‘Sin tax’ bill favors imports—Enrile

The sin tax bill being debated in Congress tends to favor imported cigarettes as it appears the proposed tax increases on tobacco products do not cover foreign brands, Senate President Juan Ponce Enrile said Wednesday.

According to Enrile, the problem is a question of equity. “My impression is that the bill tends to favor the entry of foreign manufactured tobacco products to the detriment of local products that use material grown in the country,” he said.

Enrile cited a statement made Sen. Franklin Drilon, the acting chairman of the ways and means committee, during the plenary debate on the bill.

“We are not certain at this point whether a higher tax rate for imported cigarettes would be in compliance and consistent with (the country’s) obligations under GATT (the General Agreement on Tariffs and Trade),” he quoted Drilon as saying.

Under GATT, the international trade agreement that the Philippines signed in 1994, all signatories automatically became members of the World Trade Organization (WTO) and are required to adhere to provisions that some of its critics claim are unfavorable to Philippine agriculture.

Drilon said the members of the ways and means committee “[had] not studied” whether the WTO provisions allowed higher taxes to be imposed on tobacco products imported into the country.

WTO rules require members to allow more liberalized trading arrangements among fellow members.

Sen. Edgardo Angara was the first to warn about this scenario even before the start of Senate debates on the sin tax bill. Angara was the Senate President when the chamber ratified the GATT.

Enrile clarified that he is “in favor of enforcing [an] additional tax” on sin products if the aim is to provide funds for the government’s health-care program.

However, he observed that it was unclear whether imported cigarettes would be covered once the unitary scheme of P32 additional tax per pack of cigarettes takes effect.

As it is, the entry of imported cigarettes cannot be stopped because “we have to comply with the WTO,” he said.

“What would be the rate of increase, if any, for imported cigarettes to be marketed in the country when we put in place unitary rate?” he asked.

Drilon earlier explained that “gradual increases” in taxes on tobacco products would make a pack of low-priced cigarettes cost P14 more while a higher-end brand would cost P28 more if the sin tax bill is approved.

In two to three years, the bill provides that the Bureau of Internal Revenue impose a unitary rate of P32 per pack for low- and high-end cigarettes.

The Aquino administration is aiming for a 60-percent increase in taxes of sin products once Congress passes the measure aimed at curbing alcohol and cigarette addiction among Filipinos and, at the same time, increasing revenue.

The Senate is racing against time to pass the measure, with Drilon reminding his colleagues that they have until Nov. 19 to approve it.

Meanwhile, Malacañang yesterday disputed an advertisement by local tobacco growers that claimed the sin tax bill could increase taxes on popular cigarette brands by more than 1,000 percent.

“The appearance of that ad would imply that upon the passing of the sin tax bill into law the increase will be immediately 1,000 percent. That is incorrect,” said presidential spokesperson Edwin Lacierda.

“The rate right now is P2.72 (per pack of cigarette). Next year, it will be P12. That’s hardly 1,000 (percent). After that, P22, until it reaches in 2016 to P32,” said Lacierda, without specifying any particular brand.

Even with the passage of the law, cigarettes in the country will still have the lowest price in Asia, he said.

A pack of the lowest-priced brand in Thailand is sold at P72, P26 in Vietnam, and P48.50 in Indonesia, Lacierda claimed. With Michael Lim Ubac