Ongpin, 24 others face raps over DBP ‘behest’ loans

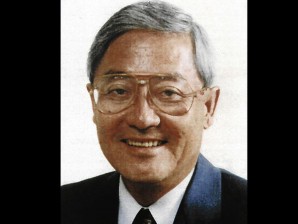

Ombudsman Conchita Carpio Morales on Thursday ordered the filing of criminal charges against 22 former officers and executives of state-owned Development Bank of the Philippines (DBP) and three private individuals, including businessman Roberto Ongpin, in connection with two loans amounting to P660 million granted to his firm in 2009.

Deltaventures Resources Inc. (DVRI) used the loan to acquire Philex Mining Corp. shares owned by DBP and sold these to businessman Manuel V. Pangilinan months later, allowing him to gain control of the country’s biggest gold producer.

The case stemmed from a complaint against the 25 respondents for violations of the antigraft law and other banking regulations. It was filed in August 2011 by DBP represented by its chair, Jose Nuñez, and its president and chief executive officer, Francisco del Rosario Jr.

The new DBP management said the accused allegedly participated in the grant under relaxed concessions of P660 million in “behest” loans used in the purchase of DBP-owned shares in Philex Mining Corp., all orchestrated in a span of less than a year.

The Senate also investigated the transactions.

In a review resolution signed on Sept. 25, Morales found probable cause to indict Patricia Sto. Tomas, former DBP chair; Reynaldo David, former president and vice chair; Alexander Magno, Floro Oliveros, Miguel Romero, Franklin Velarde, Renato Velasco and Joseph Donato Pangilinan all former board directors; and Edgardo Garcia, former senior executive vice president (SEVP) and chief operating officer.

Armando Samia, former SEVP and head of marketing sector; Rolando Geronimo, former SEVP; Perla Soleta, former senior assistant vice president; Jesus Guevarra II, former SEVP and marketing head of the branch banking sector (BBS); Crescencia Bundoc, former vice president and head of Regional Marketing Center-Metro Manila (RMC-MM); Arturo Baliton, BBS manager for RMC-Western Luzon; Nelson Macatlang, RMC-WL chief accounts management specialist; Marissa Cayetano, RMC-MM assistant manager.

They were charged with violation of Section 3(e) of Republic Act No. 3019, or the Anti-Graft and Corrupt Practices Act, in relation with the grant of a P150-million credit line to DVRI.

Aside from Ongpin, who is DVRI general manager, the two private individuals charged were Josephine Manalo, DVRI president; and Ma. Lourdes Torres, treasurer of Goldenmedia Corp. (GMC).

Morales also found probable cause to indict Sto. Tomas, David, Magno, Oliveros, Romero, Velarde, Velasco, Garcia, Samia, Geronimo, Soleta, Guevarra, Bundoc, Baliton, Ongpin, Manalo, Torres along with Ramon Durano IV, former DBP director; Benedicto Ernesto Bitonio Jr., former EVP and head of finance sector; Teresita Tolentino, former AVP; Rodolfo Cerezo, RMC-MM assistant manager; and Warren de Guzman, RMC-MM assistant manager, for another count of violation of Section 3(e) of Republic Act No. 3019, in relation with the grant of a P510-million loan to DVRI.

The charges against Benilda Tejada, Josephine Jaurique and Justice Lady Flores were dismissed for insufficient evidence.

‘Incomprehensible’

Contacted by the Philippine Daily Inquirer, Ongpin, who is in Europe, said he had yet to read the resolution of the Office of the Ombudsman.

“All I can say now is it is incomprehensible how a transaction in which the DBP earned some P1.4 billion, when the loans to my companies were fully secured and in fact paid ahead of schedule, can ever be adjudged by anyone as being unfavorable or having caused injury to the government,” Ongpin said.

“I have instructed my lawyers to oppose this judgment vigorously.”

‘Pure harassment’

David said the filing of the charges was “pure harassment and I am innocent of the charges.”

He said the transactions were done completely “in good faith.”

“In fact, if you look at it, you’ll see that the profits of the bank for these deals constituted almost a third of its income for that year,” he said.

David said the filing of only two charges among the many complaints filed by the present DBP management reflected how weak the issues being raised against him are.

Nonetheless, the former DBP president said he would “respect the process” and take remedies available to him under the legal system.”

GAME Equities

The review resolution pointed out that a majority of DVRI shares were registered in the name of Manalo and the firm’s paid-up capital amounted to only P625,000, while most of GMC’s equity was owned by Boerstar Corp. whose shares are, in turn, held in majority by GAME Equities Inc.

The resolution added that Manalo and Torres were GMC’s president and treasurer, respectively, but Ongpin was the chair and shareholder of GAME.

Philex directors

The resolution noted that in November and December 2009, Ongpin and David were directors of Philex. Ongpin was a former DBP director and is a known associate of then DBP president David.

The resolution further stated that DBP extended two loans, P150 million and P510 million, in April 2009 and November 2009, respectively, to DVRI, even though DVRI was undercapitalized.

Insider trading

It also noted the following:

- The values of DVRI securities did not comply with the collateral-to-loan ratio prescribed by the Central Bank and DBP’s credit-policy memoranda.

- There were indications that corporate layering was resorted to.

- Proceeds of the second loan were used to purchase DBP-owned mining shares, although the private company was not licensed by the Securities and Exchange Commission (SEC) as a securities dealer.

- There were indications of insider trading.

- The resolution said that DBP sold to DVRI in November 2009 about 50 million shares in Philex at only P12.75 per share.

- DVRI used the proceeds of the loan to purchase from DBP the Philex shares, which were subsequently registered in the name of GMC.

- In just a span of one month or in December 2009, the Philex shares were sold at P21 per share, or at almost double the value.

Morales directed that copies of the review resolution be furnished the Bureau of Internal Revenue, Securities and Exchange Commission and Anti-Money Laundering Council for their immediate action on the possible violations of the National Internal Revenue Code, Securities Regulation Code and the Anti-Money Laundering Act.