Aquino bullish on economy

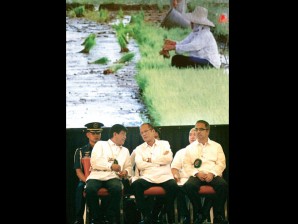

MORE GOOD NEWS President Aquino attends Thursday’s Makina Saka 2012 Agri-Machinery Roadshow at the World Trade Center with Agriculture Secretary Proceso Alcala and Science Secretary Mario Montejo. The President announced that the Philippines will no longer import rice by next year. LYN RILLON

President Aquino and his economic managers on Thursday voiced optimism that the upgrade of the Philippines’ credit rating to just a notch below investment grade would boost the country’s economic prospects and attract more foreign investments.

The Aquino administration is confident the Philippines will soon get an investment grade rating that will further lower the country’s borrowing costs, free more funds for government spending and widen the economy’s base of potential investors.

“We can now clearly make our case for an investment grade status,” Finance Secretary Cesar Purisima said in a text message to reporters.

While the Bangko Sentral ng Pilipinas had previously said an investment grade rating was possible this year, Aquino would not hazard a guess as to when a further credit upgrade would come.

“We have a saying that we shouldn’t say what we expect lest we jinx the whole thing (‘baka mausog’),” the President told Palace reporters. “(But) we definitely would work hard to get there.”

Article continues after this advertisementStandard & Poor’s Ratings Services (S&P) on Wednesday raised its credit rating on the Philippines to just one notch below investment grade, a move likely to boost bonds and currency trades and further lift an equity market that has hit new peaks this week.

Article continues after this advertisementPH peso strongest

Already, the upgrade has propelled the Philippine peso to 41.72 against the US dollar, the local currency’s strongest showing in four years. The peso is the best-performing currency in emerging Asia with a 5.2-percent gain against the dollar so far this year.

The Philippine economy grew by only 3.7 percent last year, well below the government target of 4.5 percent to 5.5 percent, but the S&P credit upgrade increases the likelihood this year’s figures will be better.

The ratings move by S&P puts the Philippines one rung below its Southeast Asian neighbor Indonesia, which bagged investment grade ratings from Fitch Ratings last year and Moody’s Investors Service early this year.

Stable outlook

S&P said it upgraded the Philippines’ long-term sovereign credit rating to BB+ plus from BB with a stable outlook, citing improved fiscal flexibility and strong external position.

Credit rating is one of the criteria foreign investors use in deciding whether to buy a government bond or invest in a particular country. Many foreign fund managers are restricted from holding debt below investment grade.

S&P said a further credit upgrade would depend on the Philippine government’s ability to generate more revenue or sustain fiscal reforms.

“The foreign currency rating upgrade reflects our assessment of gradually easing fiscal vulnerability, as the government’s fiscal consolidation improves its debt profile and lowers its interest burden,” the international credit rating agency said in a statement.

“The rating action also reflects the country’s strengthening external position, with remittances and an expanding service export sector continuing to drive current account surpluses,” it added.

S&P said the country’s high, although declining, interest expenditures and weak revenues were rating constraints, along with relatively high government foreign currency debt.

The Philippines is one of several Southeast Asian countries showing stronger signs of resilience to global turbulence as buoyant domestic spending offsets struggling exports.

More gov’t spending

Communication Secretary Ricky Carandang said the ratings move by S&P would allow the government to undertake public spending without jeopardizing its financial position.

Carandang noted that other heavily indebted countries were not as fortunate as they had to tighten belts to finance their massive borrowings.

“At a time when countries around the world are debating austerity versus stimulus, we have had the fiscal space to provide stimulus without weakening our fiscal position,” Carandang said.

In a separate statement, Budget Secretary Florencio B. Abad said S&P’s credit upgrade would result in a reduction in the government’s interest payments and an increase in government funds for socioeconomic development. A higher credit rating translates to lower interest payments on government debt.

“We remain committed to fiscal consolidation,” Abad said. “Due to our reform efforts, the national government incurred interest payment savings of P49.33 billion, or 11 percent of what was programmed for January 2011 to May 2012.”

For 2013, the government has set a target of bringing down the budget deficit to 2 percent of gross domestic product (GDP) from 3.5 percent in 2010, he said.

“We are also programmed to lowering our debt stock to 49.5 percent of GDP from 52.4 percent in 2010,” he added.

Market sentiment

In a separate statement, Purisima said the major credit rating agencies—S&P, Fitch and Moody’s—should “reflect market sentiment” in appraising the country’s creditworthiness.

S&P and Fitch both rate Philippine credit one notch below investment grade. Moody’s grades Philippine credit two notches below the coveted rating.

Purisima said earlier this year that the credit watchers’ market implied ratings index indicated that the country’s creditworthiness was underrated by four notches. “This means we should even be two notches above investment grade,” he said. With reports from Reuters and AP